$23 Trillion in Government Debt

/Here is a link to a very good website about the government debt. It’s called The Balance and appears to be presented by a group of financial advisors. The site has 10 tabs, which address these topics:

My impression is that the information given here is accurate, clear eyed, and honest. It is worth reading all the way through. If you don’t read it all, it can be summarized with these points:

The national government has consistently overspent since around World War I and has gone deeper into debt most years.

Debt has piled up especially fast since the Reagan Administration.

Over the last 40 years, government debt has increased faster while Republicans were in office than when the president was a Democrat.

Donald Trump promised to eliminate the government debt. Instead, he has increased it by $5 Trillion.

Government debt at the end of 2019 stands at close to $23 Trillion. There is an up-to-the second display of government at this link.

Most government debt is in the form of bonds and treasury bills, which investors and ordinary people buy as a form of savings. Government debt is an asset (for lenders and savers) as well as an obligation (for the government and the taxpayers who support it).

Some government debt is robbed from the Social Security Trust Fund. Current workers pay into the Fund expecting government to hold that money for them until they retire. But the government doesn’t save that money. It spends it immediately and leaves an IOU in place of the cash it took.

Government debt can (theoretically) be reduced by a) raising taxes, b) cutting spending, or c) boosting the economy.

But for all the good information, there is a blind spot in the information given by The Balance. It says nothing at all about the morality of encumbering future American with the debt. Should one person or one group of people ever be allowed to borrow money and spend it, then compel other people (who had no part in the decision to borrow and spend) to pay the debt for them? I think probably not. But that is what is happening. In one section of the linked website we find this:

It's unlikely America will ever pay off its national debt. It doesn’t need to while creditors remain confident they will be repaid.

When you read this, remember that never paying off the debt means paying interest on the debt forever. So it is small wonder those “creditors remain confident.” As long as the national government pays the interest, the creditors will be happy. But the question still stands, whether the happiness of the lender class of people should shape national policy — whether what “needs to” be done depends on what the lenders are comfortable with. Barbara Ehrenreich, a sassy far-left writer, saw the absurdity of this in an article she wrote for Mother Jones in 1988 that still makes sense today:

A free enterprise economy depends only on markets, and according to the most advanced mathematical macroeconomic theory, markets depend only on moods: specifically the mood of the men in the pinstripes, also known as the Boys on the Street. When the Boys are in a good mood, the markets thrive; when they get scared or sullen, it’s time for each one of us to look into the retail apple business. For as Franklin Delano Roosevelt once said, “We have nothing to be moody about except a bad mood itself, especially when it strikes someone richer than us.”

How much government debt is there?

Here’s another thing to be wary of when you think and read about this issue. If you seek information about government spending and government debt, you could easily find an image like the following, showing the president’s budget for 2019.

Notice the key word in the caption: “discretionary.” That’s the part of federal spending that the president or Congress can actually decide about. And to look at that, you might think the national government is attending to business. Those are all things that matter to somebody — thanks that work to the advantage of some group of Americas.

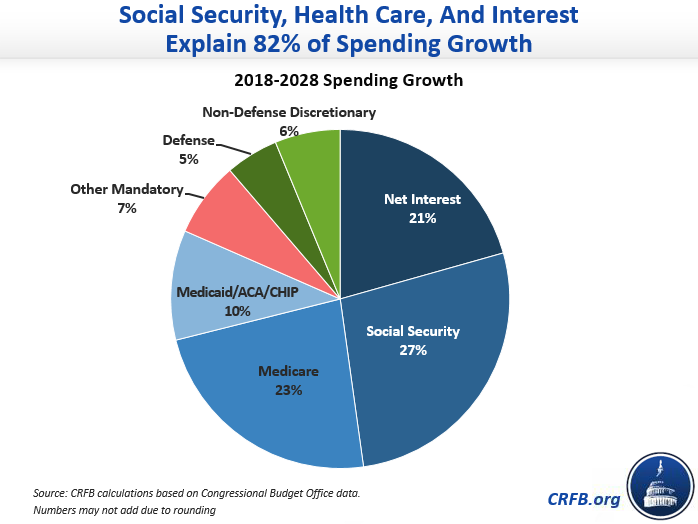

What you need to understand is that the chart leaves out the much larger part of the budget that Congress and the president can’t do much about. Everything in the above chart — which you could easily imagine as “what the government spends money on” is only the green parts of the following chart of total government spending.

Interest on debt is 21% of all government spending now. Government is already spending more on the interest from past spending than it spends on all programs for children. Interest payments will only get larger. The Republican candidate for president in 2020 promises more tax cuts — which would increase the debt. The leading candidates for the Democratic nomination are all urging expensive new health care programs — which also would increase the debt.

Discuss:

The American Revolution was ignited because American colonists had to pay taxes, but had no influence over the British Parliament. How is their complaint different from that of children and the unborn in America today, who have no votes but are being obligated to make future payments for current spending?

How important is it, in your mind, to keep Wall Street investors happy and confident?

Are you, personally, pleased that 21% of your tax payment to the federal government goes to wealthy investors rather than to government programs?